Many of you have asked for more videos on passive and semi-passive income sources, so today, I thought I would show you exactly what I do and how I make $400 per day in mostly passive income from side hustles. How I plan to double this within a year, and how you can do the same—all this and more in today’s video.

Hello and welcome to the Steven Carlson Show; I’m Steven Carlson. I am a tech entrepreneur, real estate investor, author, YouTuber, and volunteer paramedic.

Please stay to the very end of the video for some quick information on how I can help market and expand your business. Ok, enough of that, let’s get to today’s video.

In calculating my income, I wanted to keep my primary salary and profits from my tech company separate. I did this because that is more of my “day job” and not a side-hustle. Adding that income would have, of course, made the income number much larger and would have sounded cool as a video title, but that would have been dishonest. So, I decided only to add up the numbers that are from my true side-hustles, things I put less than 10 hours per week into collectively.

One last note before I get to the numbers, I also excluded dividend income that is part of my IRAs, as those are retirement accounts, and I cannot touch that money for another 20 years or more. Once again, adding those numbers would have made my total larger but would have been dishonest to the whole “side-hustle, cash in my hands daily, idea of this video.”

Now that we have set those ground rules, let’s get started. This list is in no particular order.

- The first item on my list is passive income from book sales. As you guys may know, I have written a few books (America Hijacked: How Deep State Actors from LBJ to Obama Killed for Power and Money)in the past, and while I am far from a New York Times Best Selling Author, I still make a decent income each month. Looking at my Amazon statistics, my revenue for the past 12 months was $11,741.87. Taking this and dividing by 12, I get an average income of $978.48 per month or $32.61 per day.

Of course, while this is entirely passive right now, it did take time, in the beginning, to research, write, proofread, and produce the book. Once completed, I put zero time into the book sales per month; Amazon handles sales, printing, shipping and pays me once a month with a direct deposit. Honestly, I do not even look at the stats that often; I just get a deposit each month. They do hold your money for approximately 90 days, so a book sale from today I would see around the end of December. This is just in case a customer returns the book, etc. So, keep this in mind if you publish a book with them. I have an entire video dedicated to publishing on Amazon, search YouTube for Steven Carlson Amazon publishing side hustle, and it should come up for you. - The next item on my income source list is the google AdSense revenue YouTube pays me when people watch my videos. I am not sure if I am allowed to tell you the exact amount they pay, but let’s say it is averaging about $1500 per month. This averages to $50 per day. Obviously, other channels are making ten times or more than this PER DAY, but not bad for my channel.

- This next time is a bit of a follow-up to the previous item. Occasionally you might notice I will say this video is sponsored by “X, Y, Z company.” In those cases, the company has paid me a flat rate to mention them in the ad. These fees vary, and I know I cannot tell you precisely what each is paying per video, but what I can say is average across the month for the handful of mentions I make, I am paid about $2,500 per month, this comes out to $83 per day. Included in this number are also revenues from affiliate links in the show descriptions.

I can honestly say everyone in this audience right now could start a channel. Pick a subject you are passionate about, side down in a quiet place of your house, and record. Your first few videos will suck, trust me, my first dozen videos were horrible, the next dozen, ok, and now a year later, I would still consider myself “getting started” and learning the ropes. It takes time, but the key is to make videos every week continuously. I have only missed videos on two occasions, once last year when I caught COVID and was in bed for two weeks; the second is when I was moving. Aside from that, I get out at least one video each week, most weeks two or three. - Moving to my real estate rental units. As I have covered in previous videos, back in the early 2000s, I managed hundreds of flips during the heyday of foreclosures, starting as an assistant for another investor, then moving to work my own deals. Thankfully, as the 2008 crisis started, I was already transitioning my focus to my tech startup and was spared from the big bubble pop. Now, instead of fixing and flipping, I purchase and hold, renting units out. Also, because I do not want this to be my day job, I hire property managers to handle my properties. Right now, I have just under 20 units across three states, something I would not recommend you do. I fully agree with Meet Kevin’s suggestion to only invest within a 30-minute drive of your location. The reason I am in 3-states is, 1) the state I was living in, 2) the state I thought I was moving to, and 3) the state I ended up moving to.

It would be almost impossible for me to manage my properties in different states without property managers in the area. They handle the work and send me a direct deposit each month. In fact, as I was writing this script, a receipt came in from the property manager that handles my Anchorage, Alaska properties. $6,952.58 came in from rent this month from those units, and he has already subtracted most of the daily upkeep expenses for those units. The only thing I still need to pay is the mortgage payment for those buildings.

Collectively, across all my units, I collect $12,750 per month in rent. After subtracting my mortgage payments, maintenance, management fees, etc., I am left with approx. $6025 on average, and this comes out to approximately $ 200 per day.

As a side note, if you want to see how I made an extra $20k using a little-known financing secret, check out my video https://youtu.be/cYIk7Jd23Rc - That video also covers how to get started on finding your first investment property.

The last source of passive income is from dividend stocks. As I mentioned at the beginning of this video, I did not include dividend income from stocks held in my IRAs, as those cannot be accessed without a massive tax penalty until retirement age. So, I only added up the holdings in my brokerage accounts at my bank, plus the M1 Finance Pies, Webull account, and Wealthfront accounts I regularly show you in videos.

Year-to-date, I have received $8,569.65 in dividend income on these accounts, which averages to $1,071.20 per month from Jan – Aug, and that comes out to approx. $35.70 per day.

Personally, I hate dividend stocks in my main brokerage accounts because you are taxed at a much higher rate on these, so I do not purposefully acquire stocks just for the dividends. I choose stocks that I believe in the company and want the stock value to increase, not necessarily, the income from dividends. If it happens to pay dividends, that is a bonus, but not my goal. Stocks like Apple, Microsoft, Google, Tesla, etc., I purchased for the long term.

Then in my IRAs, I load up on dividend stocks. Why? Because those are tax-advantaged accounts, and you do not have the same tax ramifications. So simply put, if I want dividend income, I put it in a retirement account, not a regular taxable brokerage account.

I have multiple videos on IRAs, just search YouTube for Steven Carlson Show IRA, and they will all show up for you.

When you add all of these daily averages up, $32.61, $50.73, $83.33, $200.83, $35.70, it comes to $400 per day, or actually $403.20 if you do not round the cents.

At the beginning of the video, I said I wanted to double this income per day. To do this, I am working on better and more engaging videos on this channel, and as the subscriber count and views increase, additional ad revenue will be generated. Additionally, I am working on two new books that are scheduled to come out next year. The first is about Emergency Medicine, teaching ground ambulance EMTs and Paramedics to flight like a flight medic from an emergency medevac helicopter. The second is a book on the historical lessons of small business owners and how those hard lessons from the past can help today’s entrepreneurs survive and even thrive in the post-pandemic world. This book is part of my #OpenForBusiness small business awareness campaign where myself and a team of other amazing YouTubers will fly in a helicopter to all of the lower 48-states, interviewing small business owners just like you for the book and for this YouTube channel.

There are still a few spots left if you want us to fly and land the helicopter at or near your office for a quick media appearance and photoshoot. Trust me, local TV and news stations love filming helicopters landing at events. Even if landing at your location is not a possibility, we can still hand out marketing material with your information on it to businesses nationwide. Jump over to my website, #OpenForBusiness and register your business today.

Follow Me On...

Steven creates video interviews with interesting people with extraordinary stories from various walks of life, sharing their successes and failures.

Full-length interviews and shorts are available on YouTube, with behind-the-scenes content and photos on Instagram and Facebook.

Keep Up to Date!

Subscribe to Steven's email list to be notified when new content is released!

Bell 206L4

For longer, multi-day, or multi-state trips, I usually fly a Bell 206L4 helicopter which seats two pilots in front and five passengers in the back.

R44 Raven II

For shorter, single-day, local 'Tampa Bay Area' videos, I usually fly a smaller R44 Raven II helicopter, which seats two pilots in the front, and two passengers in the back.

Get in touch

Have a suggestion for an interview or video?

- Corporate address

-

The Carlson Organization, Inc.

18 2nd Street

Luray, VA 22835 - Phone number

- +1 (540) 742-7001

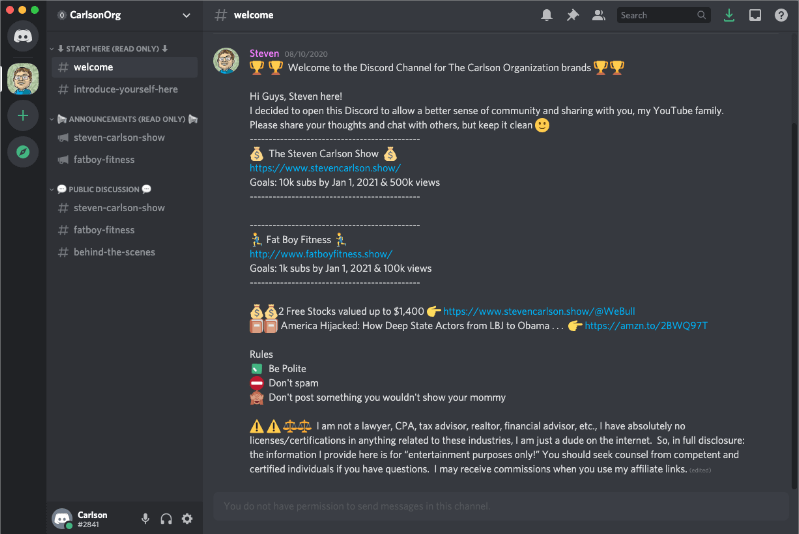

Join our community on Discord

Join in the discussion and share your insights with the community.

Join Now it's free

subscribe

subscribe